Latest Articles

Key considerations for travellers with heart conditions

16 December 2025Are you travelling abroad with a heart condition? Read my key recommendations for any recently diagnosed or…

Read more →

A Christmas gift that hits all the right notes

2 December 2025Searching for that one gift that feels a little more meaningful? You might be shopping for your partner or surprising a friend with something special…

Read more →

Travel Insurance and safety abroad: 2025 insight report

20 November 2025Our Travel Insurance and Safety Abroad 2025 insight report lifts the lid on how rising costs and risky assumptions are putting thousands of UK travellers at risk.

Read more →

Magical destinations for Christmas getaways

19 November 2025If you’re dreaming of a Christmas escape, you’re not alone. Are you looking to swap sleet for sunshine or embrace a snowy wonderland?

Read more →

How to renew a UK passport – everything you need to know

19 November 2025If your passport is close to expiring, or you’ve only just noticed it’s out of date – don’t panic. Renewing a UK passport is straightforward when you know what to expect. And the earlier…

Read more →

Travelling with cancer? Dr Frankie Jackson-Spence shares her expert advice

24 October 2025The idea of travelling with cancer can spark both excitement and uncertainty. We sat down with Dr Frankie Jackson-Spence…

Read more →

The Perfect Breeze, According to Scientists

17 September 2025There’s a special kind of joy in stepping outside on holiday and being greeted by the perfect breeze – just strong enough to cool you off, but not so strong that it knocks your hat off.

Read more →

EU Entry/Exit System (EES): What UK travellers need to know in 2025

11 September 2025Planning a holiday to Europe in 2025? If so, there’s a big change coming that you should be aware of.

Read more →

From piggy banks to passports: How grandparents are funding family holidays

4 September 2025Grandparents are playing an increasingly vital role in helping families get away…

Read more →

Jacqueline’s story: “AllClear treated us like family”

3 September 2025Find out what happened to Jacqueline and her husband when they both fell ill on their holiday to Lanzarote…

Read more →

Myth-busting: Is Travel Insurance now a legal requirement?

7 August 2025Could you really be fined €6,900 just for going on holiday without Travel Insurance? That’s what some recent headlines have claimed…

Read more →

What happens if your flight is delayed?

3 September 2025You’ve packed your bags, arrived at the airport early, and are ready to embark on your journey, only to find out your flight is delayed. It’s a scenario many travellers dread…

Read more →

Travel update: Tsunami warnings across the Pacific – Information for AllClear Policyholders

30 July 2025Following the recent 8.8-magnitude earthquake off the Russian coast and the resulting tsunami alerts issued across the Pacific, we want to reassure AllClear customers…

Read more →

Ray’s story: Travelling the world at 85 with AllClear

25 July 2025Ray, 85, from Essex, has been an AllClear customer for nine years and has never needed to make a claim. Despite having a few medical conditions, that doesn’t hold him back…

Read more →

Over 55s drive surge in European holidays for summer 2025

17 July 2025As the school year winds down and the holiday season approaches, our latest research reveals that British holidaymakers are heading to familiar European favourites in droves…

Read more →

Top 20 Most Beautiful Cruise Ports in the World

3 September 2025There’s nothing quite like the feeling of your cruise pulling into a new port. After you’ve made a lengthy journey across the ocean, or possibly battled some seasickness, the moment of arrival is often the most thrilling part of being…

Read more →

7 Peaceful summer destinations, perfect for over 50s

26 June 2025Summer is your time to escape the noise, recharge, and explore the world at your own pace. Ready to get inspired? Here are our top peaceful summer destinations…

Read more →

Flight prices too high? Travel routes for less

26 June 2025Let’s face it – finding affordable flights feels harder than ever. But the good news? It doesn’t have to be. There are still smart, wallet-friendly ways to travel…

Read more →

Is it cheaper to travel in the shoulder season? We did the maths

18 June 2025You might have heard of the “shoulder season” – that sweet spot between the high and low tourist periods – but is it truly cheaper?

Read more →

Travelling against FCDO advice? Here’s what it means for your Travel Insurance

3 June 2025When you’re planning a holiday, it’s easy to get wrapped up in flights, hotels and weather apps. There’s one thing that often gets overlooked…

Read more →

What are ABTA and ATOL? Essential travel protection explained

30 May 2025When planning a holiday, you want to know that your money and your trip are safe. Especially for those once-in-a-lifetime escapes…

Read more →

Single Trip vs Annual Multi-trip Travel Insurance: Which is right for you?

28 May 2025Whether you’re heading off for a weekend break in the UK or planning multiple holidays across Europe, Travel Insurance is essential.

Read more →

No-sweat scenery: the easiest walks to the world’s best views

3 June 2025When travelling, few moments compare to the awe of taking in a truly breathtaking view. Travelling allows you to see new views, and gives you a new appreciation for the world…

Read more →

Is it too late to book a summer holiday? (Last-minute tips)

14 May 2025If you’re still dreaming about a summer escape, the good news is – there’s still time. Are you craving sea views, countryside calm or a cultural city break?

Read more →

Hidden challenges: how to travel safely with an invisible illness

27 June 2025Travelling with an invisible illness like ME, chronic fatigue syndrome, or fibromyalgia can be rewarding – but it comes with unique challenges.

Read more →

VE Day still matters – 80 years on

8 May 2025For many of us, the 8th of May brings back powerful memories. Victory in Europe Day is a tribute to those who fought for freedom – and a reminder of the resilience that has shaped our country ever since.

Read more →

Huge powercuts in Spain and Portugal: Information for policyholders

28 April 2025A massive power cut has hit large parts of Spain and Portugal. This is an evolving situation, follow our live blog for updates.

Read more →

Are UK holidaymakers risking debt abroad?

28 April 2025Planning your next getaway? You might want to think carefully about your travel insurance. Our latest research* shows that over half of UK holidaymakers (51%) believe they could…

Read more →

Passport rules: Is your passport still valid for travel?

22 April 2025When was the last time you checked your passport? It might not be top of mind, especially if it’s been a while since your last trip. But before you start planning that well-deserved…

Read more →

Launch of AllClear’s 2025 travel trends report

7 April 2025Welcome to AllClear’s latest travel trends report. This updated edition reports on the alarming trend of holidaymakers not declaring their full medical information when buying Travel…

Read more →

6 fantastic places to see the cherry blossom closer than Japan

2 April 2025With spring upon us and the cherry blossom season in full swing, you may be getting jealous of seeing pictures of the hanami in all its glory in Japan.

Read more →

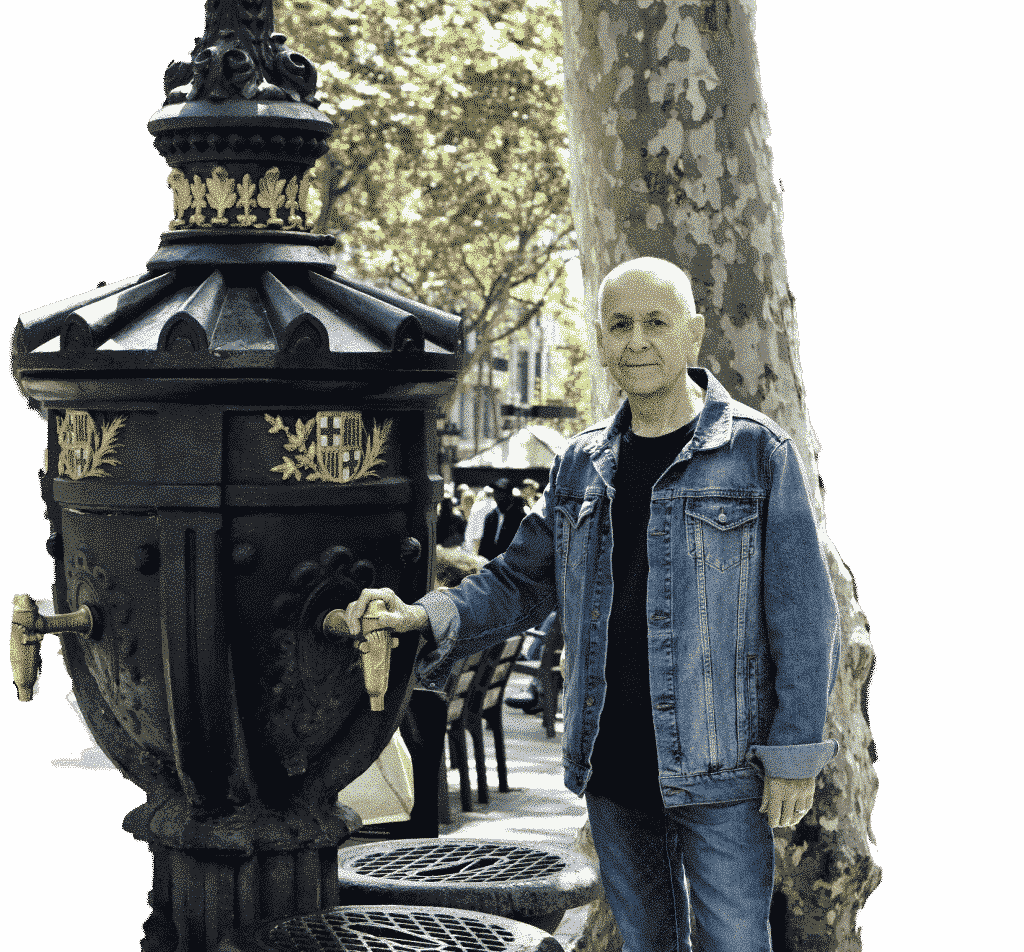

Inspirational travel stories: Ian Wardle on life after cancer

27 June 2025Ian Wardle, 67, from Chelmsford, Essex, has been an AllClear customer for three years. After recovering from Non-Hodgkin lymphoma, a condition that required chemotherapy…

Read more →

The world’s most beautiful airport landings

2 April 2025Experiencing a bird’s-eye view from an airplane is truly incredible, and whether you’re sitting on the right or left side of the plane, there are some destinations that can guarantee you…

Read more →

Heathrow airport power outage: Information for policyholders

25 March 2025A major fire at an electrical substation in Hayes, West London, has caused significant disruption to Heathrow Airport and the surrounding area. This is an evolving situation, follow our live…

Read more →

Where’s hot in March?

3 December 2025After a long, cold winter, the UK has had its first watery taste of sunlight. If that’s got you googling sunny destinations at your desk and dreaming of a last minute break in March…

Read more →

Martin Lewis says get Travel Insurance ASAB – here’s why you should listen

22 July 2025Martin Lewis has again issued his annual warning to holidaymakers, urging them to…

Read more →

The best-tasting tap water in the world

4 September 2025A new study by AllClear has uncovered the world’s best-tasting tap water, as voted by travellers on Reddit. Scotland, Norway…

Read more →

2025’s biggest travel trends for Brits

5 February 2025AllClear Travel Insurance asked a nationally representative sample of 2,000 Brits about their holiday plans for 2025. Let’s take you through the findings….

Read more →

Could you afford a million-pound medical bill?

31 March 2025Without the right Travel Insurance, you leave yourself unprotected. While keeping your adventures affordable is important, this goal can quickly fall apart if safety isn’t a priority.

Read more →

GHIC Travel Insurance Guide

27 February 2025The GHIC gives you access to state medical care while in the EU but it does not replace Travel Insurance. Here’s everything you need to know.

Read more →

Which countries require you to have travel insurance?

7 February 2025Wondering which countries require you to have travel insurance? Read our guide to find out so that you don’t get caught out!

Read more →

Flying with High Blood Pressure

3 December 2025Can I fly with high blood pressure? Read this guide for up-to-date information and top tips for travelling with high-pressure.

Read more →

Guide for planning a cruise trip

4 February 2025Whether it’s your first time planning a cruise, or you’re a veteran cruiser like Jane McDonald, there can be a […]

Read more →

Travelling after a stroke

7 February 2025Are you a stroke survivor? Find out more about flying after a stroke and where to find Stroke Travel Insurance that you can trust.

Read more →

Which medical conditions affect Travel Insurance?

7 February 2025Discover which medical conditions affect travel insurance and how to find Specialist Medical Travel Insurance.

Read more →

How far in advance should I book a cruise for the best price?

7 February 2025If you’re planning a cruise when is the best time to book it? Should you book your trip early or try and get a last-minute deal?

Read more →

What should a first-time cruiser know?

7 February 2025If you’re thinking about taking your first cruise, we’ve compiled some of our top tips to help you plain your maiden voyage.

Read more →

Does having a heart attack affect Travel Insurance?

19 February 2025We’ve answered some of the most common questions you may have about how a heart attack affects your Travel Insurance.

Read more →

When is the best month to take a cruise?

24 January 2025Planning on taking a cruise but not sure when the best time to go is? We’ve taken a look at some of the most popular destinations for you.

Read more →

Smooth Sailing: Mastering your 7-Day Cruise Budget

23 January 2025Discover how to master a 7-day cruise budget with AllClear Travel. Get tips and advice to ensure smooth sailing on your next cruise.

Read more →

Passports for cruises: When you’ll need them

23 January 2025Do you know if you’ll need your passport when a cruise passes through countries? Find out here in Passports for cruises: When you’ll need them

Read more →

What is medical screening for travel insurance?

23 January 2025Wondering what is medical screening for travel insurance? Find out information and examples to help you when you’re buying Travel Insurance.

Read more →

Travelling with cancer and disabilities

20 January 2025Key Considerations for Travellers with Disabilities and Cancer

Read more →

Do you need a visa for a cruise?

22 January 2025Cruise with confidence! We’ve clarified your visa needs, no matter where you’re cruising. Begin your extraordinary cruise adventure now

Read more →

Your travel medicine bag

22 January 2025Do you know which medical supplies you should bring on holiday? Read our guide to find out what you should keep in your travel medicine bag.

Read more →

How much medical cover do you need for Travel Insurance?

15 September 2025Wondering how much medical cover do you need for travel insurance? Read our guide to to find out the level you need for your trip.

Read more →

Flying after hip replacement surgery

3 February 2025Flying after hip replacement surgery? Discover our top tips on travelling and how to get travel insurance for hip replacement

Read more →

Travelling with cancer

20 January 2025Travelling can still be an incredible experience, but it requires just a bit more preparation. Here are the most important things I’ve learned when planning a trip as a cancer patient:

Read more →

Where’s hot in February?

16 January 2025Looking to escape the cold February weather? We’ve complied a list of the ten hottest destinations to head to this month.

Read more →The World’s Most Iconic Landmarks

15 January 2025Certain landmarks are so iconic that they consistently feature on travel itineraries, whether you’re a seasoned world traveller or are planning a dream bucket list trip for when you retire.

Read more →

The 6 best travel destinations for seniors

14 January 2025Planning a holiday? Discover the 6 best travel destinations for seniors and how to get Travel Insurance for seniors

Read more →

Where you can drink from the tap around the world

4 March 2025Most of us have plenty of questions when we’re planning a holiday, from which basic phrases to learn in the local language to figuring out what currency to use and what plug adaptors you’ll need. However, one of the most common questions, is “Can you drink from the tap?”

Read more →

Does Travel Make You Feel Younger?

27 February 2025Travel has long been seen as a way to recharge, gain new perspectives and find some rejuvenation in our fast-paced world – whether you’re living with medical conditions, or simply seeking a fresh outlook on life.

Read more →

The Best UK Airports for Accessibility and Assisted Travel

7 January 2025For those who require special assistance while at the airport, it is important to be able to plan and access information in advance of a trip.

Read more →

What are the best autumn/winter cruises?

7 January 2025Looking for a way to escape the cold and gloomy weather of autumn and winter? Why not treat yourself to a cruise holiday and explore some of the most amazing destinations in the world.

Read more →

Why you should book a post-retirement cruise

7 January 2025If you’re looking for a relaxing and rewarding way to spend your retirement, why not consider a cruise? Cruises are an excellent option for older travellers who want to see the world, meet new people, and enjoy some luxury

Read more →

Fine Dining at Sea – 5 Fabulous Cruises for Foodies

7 January 2025If you love great food and quality cruises, what better choice than a cruise that focuses on food? These fantastic cruise restaurants should please your taste buds all around the world.

Read more →

6 amazing river cruises to try in Europe

6 January 2025Cruises are a fantastic way to explore the world, letting you cover multiple destinations without feeling rushed. With plenty of luxury added in, it’s no wonder cruises are so popular with travellers

Read more →

7 tips to help you book the perfect cruise

6 January 2025Cruises are a popular choice for many holidaymakers, with our Summer Survey showing that more than 36%2 of you are interested in taking a cruise in the future. There are plenty of options for you to choose from when it comes to cruise destinations or when you go.

Read more →

Advice for flying and travelling with epilepsy

20 October 2025What are your top tips for managing epilepsy while flying or travelling, especially on long journeys?

Read more →

5 tips for solo cruises

6 January 2025Travelling by yourself can sound like a scary prospect, but going on holiday alone is becoming increasingly popular with travellers of all ages. Our summer survey in 2022 revealed that over 13% of holidaymakers plan to travel by themselves2.

Read more →

10 of the Best Christmas Markets in Europe

27 December 2024No December would be complete without a visit to a Christmas market. With bright lights illuminating festive decorations and the […]

Read more →

Where’s hot in November?

23 January 2025Want to know where’s hot in November? You can find our favourite places to soak up some winter sun in November here.

Read more →

10 essential travel hacks to make your next trip a breeze

28 October 2024Whether you’re a seasoned traveller with a well-worn passport, or planning your first getaway in years, travel hacks can transform the way you approach each trip.

Read more →

Where’s hot in October?

22 January 2025Want to know where’s hot in October? We have all the details on the hottest destinations as well as Comprehensive Travel Insurance options.

Read more →

Where Is The World’s Cosiest City?

24 September 2024The first things that might spring to mind when thinking of a holiday are the sun, sand and the glistening blue sea, but when seasons change from summer to autumn, there’s the opportunity for a completely different kind of escape: a cosy break.

Read more →

Where’s hot in September

23 January 2025Want to know where’s hot in September? We have all the details on the hottest destinations as well as Comprehensive Travel Insurance options.

Read more →

Expert tips to help you prepare for long-haul flights

20 August 2024If you’re an older traveller or have a medical condition, the idea of a long journey might seem daunting. However, with a bit of planning, your flight can be comfortable and enjoyable.

Read more →

The top 10 countries with the most Travel Insurance claims

13 August 2024With even the most seasoned of travellers at risk of becoming unwell or injuring themselves while abroad, as Medical Travel Insurance experts, we’re revealing the locations where travellers are making the most medical emergency claims, as well as which countries see the highest value of claims made.

Read more →

Travel experts share 34p seasickness hack ahead of the summer holiday season

5 August 2024We’ve got the best ways to combat travel sickness this summer, from natural remedies to 34p backpack snacks.

Searches for ‘motion sickness cures’ start to peak in July each year, with searches for ‘how to cure seasickness’ spiking by 23% in the last three months.

Read more →

Worldwide IT issues affecting flights

22 July 2024A widely-reported global IT outage on the 19th of July 2024, has impacted a number of flights, as well as […]

Read more →

How to make the most of your summer with the right Travel Insurance

24 July 2024Summer’s here, and it’s the perfect time for you to pack your bags and head off somewhere new. Older travellers in particular need to make sure they have quality cover in place.

Read more →

The World’s Most Walkable Cities

16 July 2024From Lisbon’s steep staircases to Venice’s narrow alleyways, travellers worldwide have an array of exciting cities to choose from for a city break. With excellent public transport networks and closely packed tourist attractions, however, many tourists opt to explore these destinations on foot rather than renting vehicles – meaning getting around can sometimes be a little trickier.

Read more →

Summer travel tips – Heat and medical conditions

4 July 2024High temperatures can impact various medical conditions. For example, some antidepressants (SSRIs) can make you more prone to heatstroke. If you have respiratory issues, heart problems, diabetes, or mental health concerns, staying informed can help you travel confidently and enjoy your summer.

Read more →

Where’s hot in July? And where to cool off?

24 January 2025If you’re looking to chase the sun and find somewhere hot, or hoping to cool off and chill out, there are some July fantastic destinations.

Read more →

Manchester airport closure: What to do if you’re affected

24 June 2024Flights to and from Manchester Airport faced delays and cancellations on 23rd June 2024 due to a power outage. If your holiday is impacted by the closure, you will need to contact your airline directly, who should offer you a refund or rebooking on alternative flights.

Read more →

Understanding the baggage rule changes

2 July 2024For nearly 20 years, holidaymakers have had to navigate strict fluid restrictions on planes. But good news is on the horizon!

New scanners are being introduced that should see an end to the ‘100ml’ rules for UK travellers, and no more scrambling for travel-sized shampoo before you fly.

Commemorating D-Day in Normandy

2 July 2024On 6th June 1944, hundreds of thousands of brave men, from across the globe, embarked on a mission to liberate the world from tyranny. The courage, sacrifice, and determination displayed during the invasion are forever etched in our memories.

This blog guides you through key places where you can pay your respects to those who fought for our freedom.

Read more →

Understanding fit-to-fly certificates

27 December 2024Did you know that more than nine in ten British adults (92%) are planning a holiday abroad in the next 12 months? If you’re among those hoping to travel this year, and you have a pre-existing medical condition, you may require a letter from your doctor confirming your fitness to fly. Below, we’ve outlined everything you need to know.

Read more →

Where’s hot in June?

24 January 2025June is a great time to visit a hot destination, especially in Europe. We’ve got ten of the best holiday hotspots to head to this June.

Read more →

Everything you need to know about the EU’s Entry/Exit System (EES)

2 July 2024Travel is a great source of joy, but it’s important to stay up to date before you head off on your holiday. Did you know there are some big changes coming within the EU later this year?

Read more →

6 travel influencers to get you inspired

21 May 2024If you’re looking for some inspiration and tips for your next travel adventure, you might want to check out these amazing travel influencers from the UK. They are proof that anyone can explore the world. It isn’t just millennials who can be amazing travel influencers!

Read more →

8 essential sun safety tips that every traveller needs to know

10 May 2024There’s something magical about feeling the warmth of the sun on your skin. It doesn’t matter whether you’re relaxing on […]

Read more →

Where the world wants to cruise

2 August 2024The cruising world has changed significantly in recent years, with major updates from cruise lines designed to attract more diverse […]

Read more →

What happens if you miss your port departure?

23 April 2024If you do miss a port departure, what should you do? Here are some practical tips to keep your plans […]

Read more →

Music, love, or knitting: Which themed cruise floats your boat?

23 April 2024According to the data, the 10 most popular themes are: Theme % Music 27% Culinary Experience 20% Disney 19% Historical […]

Read more →

Where’s hot in April?

27 March 2025April is a fantastic month to Chase the Sun to some hot and sunny destinations. Cancun in Mexico tops the chart at 36.7 °C in April.

Read more →

What to do if you get ill on a cruise

23 April 2024Motion sickness Caused by the ship’s movement, motion sickness can make you feel dizzy and nauseous and lead to vomiting. […]

Read more →

2024’s most popular cruise destinations revealed

22 March 2024The top 10 destinations for 2024 included: Caribbean 17% The Mediterranean 14% Norwegian Fjords 11% Greece 11% Sweden / Norway […]

Read more →

Holiday planner and packing checklist

24 July 2025More than 1 in 51 (21%) of those we surveyed hope to have 4 or more holidays in 2024. Preparation […]

Read more →

Holidaymakers risk invalidating their Travel Insurance as they shop around for cheap cover

23 April 2024Almost three in 10 British holidaymakers (29%) could be invalidating their Travel Insurance cover this year by being economical with […]

Read more →

Two of the six Which? ‘Best Buy’s’ 2024 for Travel Insurance are AllClear products

8 March 2024Which? announces its inaugural ‘Best Buy’s’ for the Travel Insurance category! AllClear Travel Insurance, is delighted to announce that two […]

Read more →

Chase the Sun – Where’s hot in March?

23 January 2025March has fantastic places to Chase the Sun. There are plenty of places close to home to pick from, and some tremendous long-haul hot spots.

Read more →

Age Co partners with AllClear to launch new Travel Insurance offer for older travellers

8 May 2024Age Co has launched a new Travel Insurance offer aimed at older travellers and people with medical conditions. The new […]

Read more →

Where are the world’s most luxurious airports?

2 August 2024Going to the airport can be an exciting part of going on holiday. Once you’re through security it seems as […]

Read more →

Three-quarters of Brits have travel plans for 2024

27 December 2024Our latest data reveals that more than three in four adults (77%) are planning a trip abroad this year, compared […]

Read more →

Make 2024 your best year ever by planning your holidays in January

23 April 2024Many of us dream of travelling more in the new year, but we often put off booking our trips until […]

Read more →

Tips to turn your winter trip into a dream come true

27 December 2024Winter is a great time to travel. While many of us like to escape the gloomy weather by chasing the […]

Read more →

Where’s hot in January?

23 January 2025Want to know where’s hot in January? We have all the details on the hottest destinations as well as Comprehensive Travel Insurance options.

Read more →

Winter sun without jet lag

25 November 2025Treating yourself to some winter sun is a great idea. With smaller crowds and sometimes lower prices, the off-season can be a brilliant time to travel.

Read more →

What to do if the airport loses your baggage

27 December 2024While lost luggage may not be as impactful as a last-minute cancellation, it can still tarnish an otherwise wonderful holiday. […]

Read more →

Fly for less: Find the cheapest days to travel

14 May 2024These days it’s essential to look after the pennies. One of the best ways to do this when it comes […]

Read more →

7 Wonderful winter staycations in the UK

27 December 2024Are you looking for a way to escape the winter blues but don’t fancy leaving the UK? If so, consider […]

Read more →

Fall in love with these 9 amazing autumn escapes

27 December 2024Are you looking for some incredible destinations to visit this autumn? Whether you want to enjoy the last rays of sunshine, admire the colourful foliage, or explore some cultural gems, we have some suggestions for you.

Read more →

6 Amazing firework displays you can see outside of Bonfire Night

31 October 2024The November nights are drawing in, and soon, thanks to a failed plot, our dark skies will light up with bright, colourful fireworks. It’s a beautiful time of year to gather your loved ones and have a great time.

Read more →

Inspirational Travel stories: Sharon Thompson

14 May 2024When Sharon Thompson was looking for Travel Insurance to cover her needs, she discovered AllClear and never looked back. “I […]

Read more →

Important cover update: Israel and the Occupied Palestinian Territories

27 December 2024Our thoughts are with all those affected by the conflict in Israel and the Occupied Palestinian Territories. If you’re currently […]

Read more →

Win an out-of-this-world experience with AllClear and the RPO

14 May 2024If you’ve ever wanted to travel to a galaxy far, far away, you don’t want to miss this competition. We’re […]

Read more →

AllClear triumphs with a triple win at Broker Innovation Awards 2023

18 September 2023We’re thrilled to announce that we swept the boards at the recent Broker Innovation Awards 2023. AllClear won in all […]

Read more →

Experience the best of music and travel with AllClear Travel Insurance and the Royal Philharmonic Orchestra

13 May 2024AllClear Travel Insurance and the Royal Philharmonic Orchestra have teamed up to offer you some fantastic musical experiences. You can […]

Read more →

The 9 biggest mistakes to avoid at the airport

27 December 2024Travelling is a wonderful experience, but it can be stressful, especially when dealing with airports. Long queues, security checks, baggage […]

Read more →

The new Wonders of the World

27 December 2024Getting the right Over 70s Travel Insurance can feel like a minefield, but getting older and living with pre-existing medical […]

Read more →

The AllClear Consumer Travel Report 2023

27 December 2024The travel and tourism industry has been through a tough few years. COVID-19 hugely disrupted international travel, and now UK travellers […]

Read more →

UK air traffic control issues: What to do if you’re affected

4 September 2023The UK’s central air traffic control system malfunctioned for four hours on Monday, 28th August, causing considerable delays for passengers. […]

Read more →

Too close for cover? Holidaymakers overlook insurance for short-haul holidays

27 December 2024Our newest research has revealed an alarming trend. Nearly half of people with medical conditions (46%1) said they wouldn’t bother […]

Read more →

Why it pays to plan your airport parking

27 December 2024Did you know that Over 61 million passengers passed through Heathrow airport in 2022? That’s an average of over 150,000 […]

Read more →

Travel advice: European wildfires

27 December 2024We understand that the recent news about the devastating wildfires in Greece, which have affected thousands of locals and tourists, […]

Read more →

Will Europe be too warm for holidays by 2028?

27 December 2024Our recent survey shows 71% of UK adults think many Mediterranean destinations will be too warm to travel to by […]

Read more →

What to do if your passport is lost or stolen

27 December 2024Making sure your passport is safe and sound is one of the most important things you can do on holiday. […]

Read more →

An exclusive look behind the scenes of our new TV ad!

27 December 2024Take a peek behind the scenes at AllClear with an exclusive look at the making of our fantastic new TV […]

Read more →

How to save on all-inclusive trips this summer

27 December 2024If you’re heading off to an all-inclusive resort this summer, we’ve got plenty of tips to help you keep costs […]

Read more →

Unearthing Europe’s treasures

5 March 2025If you’re eager to explore Europe this spring but want to try something new, why not avoid the usual […]

Read more →

The art of solo travel: 6 tips for seeing the world on your own

20 September 2023The art of solo travel: 6 tips for seeing the world Seeing the world on your own can be a […]

Read more →

On track for a greener future: Europe by train

27 December 2024Get a new perspective on Europe, by choosing sustainable train travel that allows you to experience much more of the […]

Read more →

Exploring the World with MS: Expert tips for travelling with Multiple Sclerosis

27 December 2024If you or someone you are travelling with has Multiple Sclerosis, there are some unique challenges you may face. At […]

Read more →

6 perfect destinations for your spring holidays

27 December 2024Spring is a beautiful time to travel and see the world. Plenty of unique destinations are warming up, and some […]

Read more →

Safety considerations falling among vulnerable travellers as cost of living crisis renews focus on the price of holidays

24 January 2025A renewed focus on holiday prices A year on from the removal of Covid restrictions, new research suggests a growing […]

Read more →

50 percent rise in number of older people jetting abroad for winter holidays

27 December 2024Winter holidays growing in popularity with over 55s New research from AllClear Travel Insurance suggests that the number of over […]

Read more →

Picture perfect: Tips and tricks for compliant passport photos

27 December 2024When applying for your passport, making sure your photo ticks all the boxes can be a little stressful. Nobody wants […]

Read more →

Martin Lewis talks specialist Travel Insurance

27 December 2024“You have a pre-existing condition… You’ll be looking at some form of specialist insurance policy to get the price down, places […]

Read more →

Martin Lewis’ advice for planning a holiday

27 December 2024Recently, Martin Lewis, who founded MoneySavingExpert.com, shared his advice for booking a trip away. Mr Lewis gave the top tips […]

Read more →

Flybe Collapse: What You Can Do

27 December 2024Collapse of Flybe: Information for Travellers and AllClear Policyholders Flybe has ceased trading after going into administration on 27th […]

Read more →

7 of the best places to visit at Christmas

27 December 2024Christmas is less than a month away, but there’s still plenty of time to arrange a last-minute Christmas getaway. If […]

Read more →

New visa waiver program for UK travellers heading to Europe in 2024

27 December 2024Starting in 2024, UK travellers will need to pay an extra £6 if they plan to travel within the Schengen […]

Read more →

AllClear opens new office in Cardiff

27 June 2023Cardiff office is fourth UK site for the company AllClear Group, one of the UK’s fastest growing travel companies, has […]

Read more →

51 of the best travel apps for your holiday

20 May 2024These days it feels like there is an app for everything. Most of them make our lives easier, and some […]

Read more →

AllClear wins four prestigious awards in a week.

2 July 2024AllClear Travel Insurance was the winner of four national awards in September, receiving prizes at the Broker Innovation Awards 2022 […]

Read more →

All-in-one guide to Germany

14 March 2024Over half a million Brits head to Germany every year. Germany is so full of culture and history that it’s […]

Read more →

The ten most photographed places in the world

23 September 2022Holiday photos have been a vital part of the holiday experience for decades. They help us to relive the trip […]

Read more →

All-in-one Guide to Turkey

23 September 2022The meeting place between two continents, Turkey has always been a crossroad of the world. This ancient cultural touchstone draws […]

Read more →

All-in-one guide to Cyprus

21 September 2022The beautiful island of Cyprus sits in the azure Mediterranean sea and basks in the sun for 300-340 days of […]

Read more →

Most beautiful places to visit in the UK

27 December 2024This beautiful country of ours has a lot going for it, especially the natural views on offer! We’ve listed some […]

Read more →

What can you do about airport strikes affecting your holiday?

15 May 2024British Airways staff have suspended the most recent set of planned airport strikes. Good news for travellers who have flights […]

Read more →

One in four holidaymakers give false information to get cheaper Travel Insurance

2 July 2024One in four British holidaymakers (25%) could be invalidating their Travel Insurance cover this summer by being economic with the […]

Read more →

Useful travel links

14 May 2024There are a lot of things to take care of when you’re organising your holiday. To help you track it […]

Read more →

All-in-one guide to Italy

14 May 2024Italy attracted 5.11 million of us in 2019, and for a nation so steeped in history and culture it’s easy […]

Read more →

All-in-one guide to Portugal

14 May 2024Portugal and the UK have been allies since 1373, which may be one reason over 3 million of us headed […]

Read more →

Top ten Blue Flag Beaches to visit

2 July 2024Relaxing on a beach has long been an essential part of our holidays. If you want a clean and eco-friendly […]

Read more →

Inspirational Travel stories: Sheila Lowrie

14 May 2024Sheila Lowrie has been with AllClear since 2015. In the summer of 2017, She was to discover the true importance […]

Read more →

Airports travel disruption: Here are our top tips to help alleviate the risks

27 December 2024You’ve probably seen the news lately about some disruption at UK airports. While there has undoubtedly been some disruption, there […]

Read more →

All-in-one guide to visiting Greece

14 May 2024Before you go to Greece With its slower paced lifestyle, great food and stunning vistas, it’s no surprise that Greece […]

Read more →

All-in-one guide to visiting France

14 May 2024Before you go to France France is a popular destination for us. In 2019, 10.5 million Brits crossed the Channel […]

Read more →

All-in-one guide for visiting Spain

14 May 2024Before you go to Spain Spain has been a popular destination for us Brits for a long time. In 2019 […]

Read more →

Can over 70s get Travel Insurance?

27 January 2025Travel Insurance for the Over 70s During a recent survey we conducted, over a quarter of those aged 71-75 are […]

Read more →

What to do if you are impacted by disruption at UK airports?

24 December 2024The number of Britons planning an overseas summer holiday has doubled since last year, rising from 34% to 64%1. Unfortunately, […]

Read more →

Quizzes to inspire your future travels

4 December 2025Need travel inspiration? Inspiration can come from anywhere, and it’s no different when choosing where to go for your next […]

Read more →

Post Brexit Travel: GHIC cards, roaming charges and Visas

27 December 2024The UK has officially left the EU. From January 1st 2021, many new rules came into play, some of which […]

Read more →

Planning an Easter trip?

2 July 2024Easter is a great time to spend more time with friends and family, with many using the extra days to […]

Read more →

What happens if you don’t declare medical conditions for travel insurance?

2 July 2024Not all health conditions are long term. Consequently, many people are not aware that they need to declare their pre-existing […]

Read more →

Top tips for those travelling with hearing loss

27 December 2024Did you that there are around 11 million people across the UK with hearing loss? The greatest amount of hearing […]

Read more →

Solo Travelling Over 60 – Singles Holiday Ideas / Inspiration

23 January 2025The saying goes that life begins at 40, but it’s often those approaching retirement who have the most freedom to […]

Read more →

UK Winter Staycations

27 December 2024While holidays abroad are exciting so are UK staycations! With Christmas on the horizon, you may be one of the […]

Read more →

‘Never give up’: Gayle’s story

8 May 2025Gayle has been an AllClear customer for almost 10 years. She has been grateful for the support and help provided for people like her with pre-existing medical conditions…

Read more →

How AllClear gave Philip the confidence to keep cruising

15 May 2024After living in lockdown for more than a year, Philip Jolly, his wife (Barbara) and their son (Daniel) took the […]

Read more →

Joe Edgar’s story: How AllClear Travel helped stranded couple following pandemic outbreak

14 May 2024Joe Edgar and his wife, from Glasgow, were on a holiday in Australia for a family wedding back in March. […]

Read more →

AllClear’s Annual Travel Insights Report

27 December 2024Published on: 20 Jan 2021 Read our Annual Travel Report to understand how the Pandemic has affected holidaymakers as the nation […]

Read more →

Travel corridor confusion: Two thirds of Brits say they have no idea which countries are safe to visit

27 December 2024Two in three British adults (65%) have no idea which countries are safe to travel to under the Foreign, Commonwealth […]

Read more →

Travelling with High Cholesterol

6 February 2025COVID-19 travel regulations for those with high cholesterol If you have high cholesterol and wish to go on holiday, you […]

Read more →

Travel Vaccinations Guide

27 December 2024Travel vaccinations Whether you’re soaking in the atmosphere in India or heading to the vineyards of South Africa, you’ll need […]

Read more →

Medical conditions that prevent flying and finding alternative methods

1 August 2024Medical Conditions That Prevent Flying For many holidaymakers, health plays a huge role in planning a trip. Medical conditions that […]

Read more →

Travelling with metal implants

24 November 2023Travelling with metal implants It can seem daunting to stay up to date with the new measures, particularly when travelling […]

Read more →

Preparing for a holiday with a Medical Condition

3 February 2025COVID-19 Travel Regulations for those with a Medical Condition Going on holiday is exciting! But if you’re one the many […]

Read more →

National dishes from around the world

19 December 2024Experiencing the local cuisine from our favourite destination is, for many of us, a true holiday highlight. However, sadly in […]

Read more →

How does Travel Insurance work?

27 December 2024You buy Travel Insurance for a reason. It’s there to protect your holiday, and to help you should you need […]

Read more →

Travel to Turkey Visa Free

27 December 2024Travel to Turkey Visa Free Turkey has decided to exempt visa requirements for citizens from the United Kingdom. This means […]

Read more →

AllClear Customer Stories: Specialist Cover Keeps Cancer Patient Cruising

14 May 2024Specialist cover keeps cancer patient cruising Specialist cover keeps cancer patient cruising John and his wife Linda love to travel, […]

Read more →

Holiday Protection: End Supplier Failure and Scheduled Airline Failure

7 February 2025After booking your holiday, it is understandable that you would want to safeguard your trip in case of the financial […]

Read more →

Over 70s Travel Insurance:The Shakespeare Story

9 January 2025Michael and Diane Shakespeare are in their 70s and love to travel. Having previously enjoyed active cycling and sailing trips, nowadays all-inclusive package holidays to European destinations such as Madeira are their favourite means to relax and enjoy a break.

Read more →

Money Saving Expert Martin Lewis Makes Travel Insurance Plea

6 August 2024Money-saving guru Martin Lewis appeared on Good Morning Britain and pleaded for you to buy your travel insurance the moment […]

Read more →

Tales from AllClear Customers

27 December 2024We would once again like to thank our customers who took part in our poetry and short story competition back […]

Read more →

Palau Bans ‘Reef Toxic’ Sunscreens

27 December 2024In a world-first, the Pacific island nation of Palau has banned sunscreens that are harmful to corals and sea life.Plans […]

Read more →

AllClear Partner & Cricketer Oliver Pope Announces Himself on the World Stage

27 December 2024Oliver Pope has come of age. The England cricket team put together a fine performance in the third test […]

Read more →

Australia’s Bushfires – Is It Still Safe To Travel There?

27 December 2024The blazes have been burning across Australia for months. It has destroyed homes and wiped out entire towns across Australia […]

Read more →

The Best Desert Holiday Destinations on Earth

27 December 2024Deserts are among the best places in the world for adventure. From treks across incredible landscapes to gazing at the […]

Read more →

AllClear Appoints New CFO to Support Business Growth

15 May 2024AllClear, the specialist medical travel insurance provider, announces the appointment of Cameron Jack as Group CFO, to support company growth […]

Read more →

Top Tips for Travelling with COPD

28 January 2025Chronic obstructive pulmonary disease (COPD) affects millions of people around the world, including more than 2% of the UK’s population. If you […]

Read more →

5 Top Recuperating Holidays for Travelling After Cancer

28 January 2025Cancer recuperation retreats are on the up! For a long time, spa therapists have been under the impression that their […]

Read more →

Travelling With A Disability – Disabled Holiday Ideas & Tips

24 January 2025If you are holidaying with a disability, you may need some extra planning and a few new ideas… That’s why […]

Read more →

8 spooky destinations for a Halloween holiday

27 December 2024If you’re looking for something to sink your teeth into this autumn, why not take a trip to any of […]

Read more →

AllClear Customer Stories: The Cook Family

14 May 2024In just over a year, Tom Cook had to claim on his travel insurance twice to the total value of […]

Read more →

AllClear Team Member, Lydia, Shares Her Story About Travelling with Epilepsy

25 March 2021The trip I’d never forget. I had never been to Lanzarote before and was excited to be going away with […]

Read more →

Travelling with Breast Cancer Guide

24 January 2025Did you know breast cancer is the most common cancer in the UK? Around 55,000 women and 370 men are diagnosed with breast […]

Read more →

How to Ease Joint Pain While Flying

24 January 2025It can be a challenge for all of us, even at the best of times, to get and more importantly […]

Read more →

Top Tips to Avoid Germs When Flying

14 May 2024Unfortunately, flying is one of the easiest ways to pick up a bug and it’s no surprise – you’re stuck […]

Read more →

Top Tips for Flying with a Visual Impairment

27 December 2024Did you know that at least 2.2 billion people around the world have a vision impairment or blindness? There are now […]

Read more →

Top Travel Tips for Travelling With Epilepsy

24 January 2025Travelling with Epilepsy Does having epilepsy prevent you from travelling? No, absolutely not! Do you need to do a bit […]

Read more →

How an over 70’s Couple with Cancer Attended Their Son’s USA Wedding

14 May 2024Most parents dream of seeing their children getting married, but what if the wedding was abroad and your travel insurer […]

Read more →

A guide to insurance when airlines or travel companies go bust

10 December 2025In recent years we’ve seen the collapse of several airlines and travel companies – such as Monarch, Jet Airways and […]

Read more →

AllClear UK Wins Fourth Industry Title

14 May 2024Specialist medical travel insurance provider AllClear is celebrating a clean sweep after winning Personal Lines Broker of the Year at […]

Read more →

Understanding, Treating and Travelling with Eczema

28 January 2025One in five children develop eczema, and over 1.5 million adults in the UK live with eczema today. It’s a […]

Read more →

The Pros and Cons of Travel Reward Cards

24 January 2025Should I Sign up to a Travel Reward Card? If you’re holidaying a few times a year or travelling for […]

Read more →

Living with a Stroke

24 January 2025Living with a stroke isn’t easy, but with the right information and support, things can start to feel better soon. […]

Read more →

The Best and Worst Destinations to Fall Ill on Holiday

27 December 2024Where does your holiday destination rank for healthcare? After all, the Association of British Insurers (ABI) have revealed that a […]

Read more →

Travel Insurance and Brexit

2 May 2024Stepping away from the discussions, debates and the latest political moves at Westminster, most of us are concerned about how […]

Read more →

Retired Judge Rules Specialist Travel Insurance Value for Money

15 May 2024Richard Davis, a retired judge from the South of England, was diagnosed with cancer in 2016, and told he had […]

Read more →

Interview with Denise Waterman: Star of AllClear’s TV Advert

14 May 2024Denise Waterman, 57, is an acclaimed musician, actor, presenter and model. You may recognise her from the latest AllClear advert […]

Read more →

Mature Rockers Ruling the Festival Scene

15 May 2024Glastonbury is over for another year, so we thought now was the perfect time to pay tribute to it. Glastonbury […]

Read more →

Over 70’s Couple with Multiple Medical Conditions Keep on Cruising

15 May 2024Graham and Gillian Ackrill are both in their seventies, and like many their age live with multiple medical conditions. Still, […]

Read more →

Top 10 Places in England for History Lovers

19 December 2024England is steeped in history… From castles to cathedrals, Roman ruins to coal mines – this small island has seen […]

Read more →

10 tips for Travelling with Someone who needs Full Time Care

24 January 2025Travelling can be one of the best gifts you can give to the person you care for. You can both […]

Read more →

Top 5 wine tours in Europe

27 December 2024One of the greatest writers of the 20th century, Ernest Hemingway, once said of wine: “It is one of the […]

Read more →Keeping Safe while on your Travels

27 December 2024Travelling should be a fun and relaxing experience. We all look forward to getting lost in a new city, exploring […]

Read more →

The most popular Spanish cities for holidaymakers

27 December 2024Spain continues to be an immensely popular destinations for tourists: with 81 million visitors worldwide flocking to the country during 2018. […]

Read more →

Travelling with a mental health condition

8 May 2025How to manage your mental health condition on holiday Travel is an opportunity for new experiences, relaxation, and a re-charge […]

Read more →

New Group to Support Access to Travel Insurance for Vulnerable Customers

27 December 2024A new working group comprising leading medical charities, the British Insurance Brokers’ Association (BIBA) and AllClear Travel Insurance, has been […]

Read more →

Top 10 safest countries to visit in the world

24 December 2024Safety is a number one priority for us on holiday. Or at least it should be! You might think that […]

Read more →

Double award winning AllClear – Gold at industry awards!

15 May 2024We are delighted to have won two awards at the Insurance Times Awards 2018! AllClear won GOLD for Personal Lines Broker of the […]

Read more →

How to choose Travel Insurance: 5 top tips

14 May 2024Naturally, the first thing many people check is the price of the quote, but how often do you really explore what […]

Read more →

Find out how 55 year old Catherine enjoys fabulous holidays after cancer

26 February 2024Our customers are more adventurous than ever! We’re proud to see many of them still getting round to those trips […]

Read more →

Top 10 up and coming city breaks in Europe

15 May 2025European city breaks are big business, and with so many great destinations to choose from travellers are spoiled for choice! […]

Read more →

What Is Curtailment? Do All Insurance Policies Cover It?

27 December 2024As the author Hans Christian Andersen said: “To travel is to live.” And we Brits tend to agree, with […]

Read more →

Travelling with medications: How to pack your hand luggage

19 December 2024A missing tablet can be a lot worse than forgetting a towel! So packing takes on a whole new priority […]

Read more →

Finding Happiness After Cancer

2 June 2025Friend of AllClear, Avril, was previously diagnosed with cancer. After overcoming active treatment and her fears for the future, she […]

Read more →

Holiday Ideas & Destinations For Older Couples

27 December 2024Travel is top of the agenda! More than one in two British adults (57%1) is planning an overseas holiday in […]

Read more →

Can you fly with a blood clot?

24 November 2023Before you fly with a blood clot – understand what a blood clot is Blood clots are vital to our […]

Read more →Why is Travel Insurance important?

27 December 2024Deep down you may be thinking: ‘Do I need Travel Insurance? Is it worth it?’ Claims statistics by the Association […]

Read more →

Do I need travel insurance for Europe?

27 December 2024How to choose the right cover for a European holiday Each country in Europe has different healthcare systems, EHIC rules […]

Read more →

Top 4 injuries to avoid on holiday

27 December 2024Getting injured whilst away is a holidaymakers worst nightmare! Not only are you in a foreign place, but you might […]

Read more →

Enter our Easter Prizedraw

2 July 2024a Rafflecopter giveaway Good luck! We’ll be announcing the winner on Tuesday 3rd April via social media. In the meantime […]

Read more →

The top 5 city breaks in Europe

24 January 2025Looking to escape the daily grind? Check out these getaways for a new city experience in Europe Here are five […]

Read more →

Why a Heart Condition Didn’t Stop Graham’s Favourite Holidays

15 May 2024A Customer story Enjoying Retirement Graham Cole and his wife, both in their mid-to-late 70s are enjoying their well-deserved retirement […]

Read more →

Exploring Europe in a campervan: A customer story

15 May 2024Sue Ashmore and her husband Roger have always travelled. They own a campervan and have holidayed all over Europe, including […]

Read more →

3 top destinations for travelling with children

19 December 2024Bringing young children on a big family holiday can give you wonderful moments for the photo album. But get your […]

Read more →

Venturing the globe with heart conditions: Customer’s inspiring story

27 December 2024The diagnosis Lynne Joseph has always loved to travel. Now in her late 60s, Lynne and her husband James […]

Read more →

12 tips for travelling with someone who has dementia

24 January 2025We all complain about it – but travelling to our holiday destination can actually be quite fun. It’s not just […]

Read more →

When can you fly after DVT?

23 November 2023Can you fly after DVT? Up to one in every 1000 people are affected by Deep Vein Thrombosis in the […]

Read more →

Solo travelling for seniors

28 January 2025Why travelling on your own in your later years is wonderful after all The senior traveller going solo has many […]

Read more →

Have you checked if your holiday is ATOL protected?

27 December 2024ATOL protection – What it is and why it’s Important Aside from travel insurance, when planning your trip it’s wise to […]

Read more →

Top 5 holiday destinations if you’re over 70

3 February 2025The trips you should consider for your next holiday Holidays can prolong your life – it’s true! Research by Dr […]

Read more →

Travellers over 65: Inspiring stories

15 May 2024Wanderlust knows no age limits You might think that traveling around the world is only for backpackers in their […]

Read more →

Travelling the world when you have rheumatoid arthritis

22 September 2022This blog tells the inspirational travel story of an AllClear Customer, Patricia Senior. The obstacle of getting travel insurance for […]

Read more →

7 ways to save money when travelling

24 December 2024How to keep your money in your pocket and your feet travelling Going on holiday is probably the best way […]

Read more →

Protect yourself from these 7 travel scams

2 May 2017Don’t fall victim to these travel scams Travel is an amazing part of life. The chance to experience new cultures […]

Read more →

What does Travel Insurance not cover

27 December 2024Our research shows that almost three quarters (73%) of holidaymakers fear that their insurers will not pay out in the […]

Read more →

Flying with diabetes

19 December 2024Holidays are a time to relax and forget about your worries. For those flying with diabetes, your travels should be […]

Read more →

Inspirational travel stories: Adventures after 70

24 January 2025Below is Chris Smith’s AllClear customer story. He is an avid traveller who did not let age or medical conditions […]

Read more →

Double lung transplant recipient travels the globe with the help of AllClear

15 May 2024Double lung transplant recipient travels the globe Her dilemma After receiving a double-lung transplant in 2009, Kirsty Geddes, now in […]

Read more →

Inspirational travel stories: Vi’s trip to St Petersburg

15 May 2024Ballet and opera in Russia What happened to Vi? In 2012 I’d had a major shoulder injury which required invasive […]

Read more →

Heart transplant patient challenges scariest Disney rides

12 August 2024Nurse Nicola Hague is a heart transplant patient who had a devastating stroke at just 18. Nicola’s parents sought Medical Travel Insurance cover from AllClear. This is their AllClear Customer story.

Read more →Travel Insurance: Winning hearts and minds

15 May 2024Below is a customer story from Michael Burt, a man who received the country’s first-ever beating heart transplant and wanted […]

Read more →

Wise investment pays off for cardiac patient

15 May 2024Here is Barry Everett’s customer story. A man who travels a great deal, but had a double cardiac arrest. He […]

Read more →

Do you consider the level of healthcare in a destination before you choose to go on holiday there?

3 February 2025The weather, the culture, sightseeing, the food, a friend’s recommendation and how long it takes to get there may all be […]

Read more →

A holiday disaster averted – an AllClear customer story

4 April 2025Read George Stewart’s AllClear customer story. He loves to travel to Costa Adeje, but on one particular occasion, what could have […]

Read more →

Guest post: Holiday without MSing all the fun!

27 December 2024by blogger Lisa Helms Travelling when you have Multiple Sclerosis can feel a little nerve-racking. I used to be absolutely […]

Read more →